Time to Go EM Local Currency?

01 December 2020

Share with a Friend

All fields required where indicated (*)The VanEck Unconstrained Emerging Markets Bond UCITS Fund utilizes a flexible approach to emerging markets debt investing and invests in debt securities issued by governments, quasi-government entities or corporations in emerging markets countries. These securities may be denominated in any currency, including those of emerging markets. By investing in emerging markets debt securities, the Fund offers exposure to emerging markets fundamentals, generally characterized by lower debts and deficits, higher growth rates and independent central banks.

Market Review

Our basic stance remains and the changes we made were largely telegraphed in previous monthlies—we’ve generally been more diversified and selective after the “buy of the century” view started to get fully priced in July. Since then, we’ve gradually reduced some of the high-flying winners, as discussed in our monthlies. These have generally been in USD. Replacing them are mostly EM local currency markets. Importantly, we’d note that not all local currency markets are the same and a number of EM local currency markets (such as China’s) are low volatility affairs. Anyway, given these developments in the portfolio, we thought we’d review “the case for EM local currency”.

What’s the case for EM local currency? EMFX has lagged and many currencies have good policy that can offer a combination of defensive and offensive (i.e., beta to growth) characteristics. We’ll go into that argument in detail, below. What we should add, though, is that the global context supports EM local currency bond markets in many ways. Global government bond markets are undergoing two serious challenges right now. First, many of them pay low yields or even a high probability of losses. Their safety value is arguably fully priced, if not subject to distortive “hothouse” effects. Second, the classic “60/40” stocks/bond portfolio is challenged by these low or negative yields on many developed markets (DM) bonds. We think EM bonds will be a growing answer to filling in whatever that, perhaps declining, “40” is.

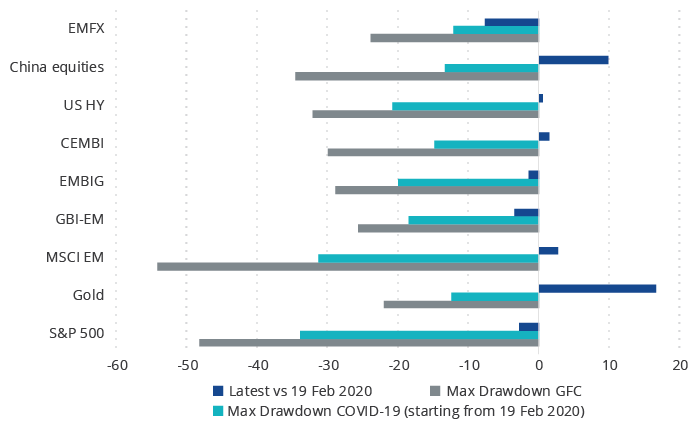

EMFX hasn’t even retraced half of its pre-COVID lows. Let’s discuss lagging and catching-up, first. Exhibit 1 below makes the point that most asset prices are largely back to their pre-COVID highs, with gold (wow!) and Chinese equities (even more impressive!) being well above pre-COVID highs. (VanEck happens to have leading funds in both gold and EM equities). Everything else—including all the EM debt categories such as the EMBIG and CEMBI—is back to pre-Covid levels. Except for EMFX, though—it’s only retraced under half of its pre-COVID lows.

Exhibit 1 – Asset Prices Near Pre-COVID highs

Max Drawdowns: GFC vs. COVID-19

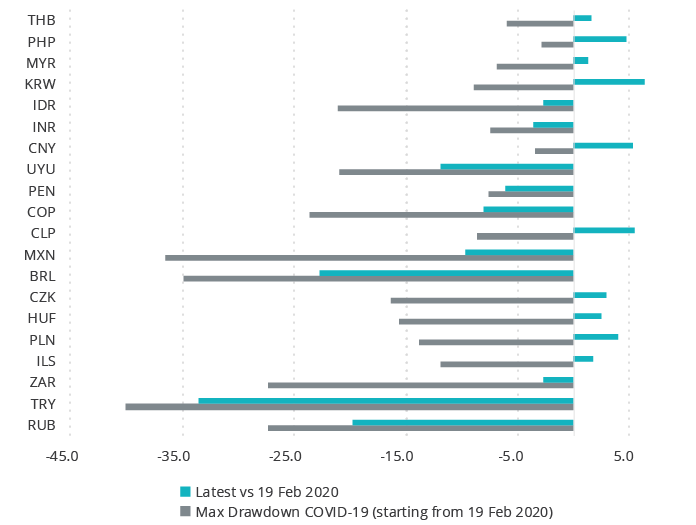

There are a number of individual EM foreign currencies that have lagged significantly, but which do not have an obvious fundamental that deteriorated enough to explain it: why is the Russian ruble down in line with the (so far) de-rating Turkish lira? Exhibit 2 goes through the major EMFX in detail. The ruble really stands out to us, given the country’s low debt, high reserves, plenty of fiscal and monetary space and improving economic structure. We don’t see a good reason for this lagged currency performance. Similarly for Peru, which has beta to global growth due to its mining sector, but also great defensive characteristics due to its strong balance sheet and good policy track record. Both of these examples pay high real interest rates relative to their fundamentals, consistent with the core of our investment process, of course.

Exhibit 2 – EMFX Has Some Big Laggards

EM FX Performance during COVID Crisis (%)

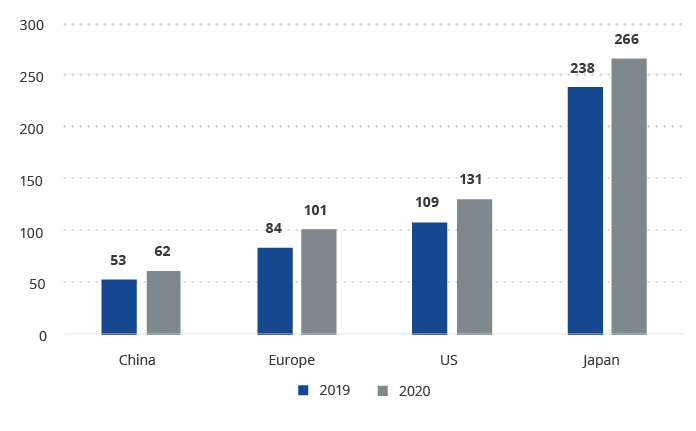

Another reason supportive of local currency is their policymakers’ generally orthodox stances—paying high real interest rates and maintaining fiscal space via limiting debt and deepening structural reform. China will be our poster child for this type of bond market. First, let’s look at Chinese government debt, relative to DM. Fine, a large portion of Chinese debt is on the part of corporates with varying degrees of implicit government support, but let’s put that aside given the tightness of the country’s financial controls. China has a lot of flexibility to stimulate, if growth is needed to drive asset prices, but also pays high real yields if growth doesn’t materialize quickly.

Exhibit 3 – China Maintains Fiscal Space

General Government Gross Debt, % GDP

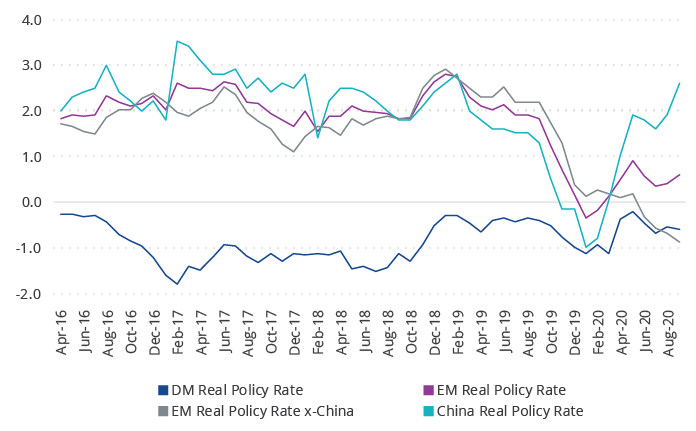

Another example of policy orthodoxy which rewards government bondholders also comes from China. The Exhibit below shows the higher real policy rates offered by Chinese bonds. This is a reflection of the Chinese authorities’ position of strength. They do not have to gin-up growth and markets without end and can afford to tighten policy when needed. This obviously optimizes long-term outcomes, because any adversity can be met by loosening. It’s a sign of strength to be tightening policy in the current nascent growth environment.

Exhibit 4 – Higher Chinese Rates A Sign of Strength

Selected Global Real Policy Rates, %

Exposure Types and Significant Changes

The changes to our top positions are summarized below. Our largest positions in October were: Mexico, China, South Africa, Thailand and Indonesia.

- We increased our local currency exposures in South Africa and Russia. The main driver in South Africa was the expectation that the government’s budget presentation will be realistic, with a clear path to the stabilization of the debt-to-GDP ratio. These expectations fully materialized. As usual, there are implementation risks, but for now these developments improved the country’s policy test score. In addition, there are clear signs that the historically low prime rate is having a positive impact on consumption and growth. In terms of our investment process, this improves the country’s economic test score. As regards Russia, a lot of bad news related to geopolitics is already priced in (for example, the ruble is among the worst-performing currencies despite stellar macroeconomic fundamentals), which improves the country’s technical test score. Against this backdrop, it is becoming increasingly difficult to justify having a big underweight in Russia.

- We also increased our local currency exposures in Malaysia and Peru. One reason for choosing Malaysia is that the currency has one of the highest historic correlations with CNY, so it presents a good way to get diversified exposure to the region and express the China growth outperformance theme. In terms of our investment process, this improved the country’s technical test score. Peruvian assets suffered a lot in the past months due to a very high COVID mortality rate, a very deep recession and a lot of political noise associated with withdrawals from local pension funds and attempts to impeach the president. These developments improved local valuations and limited future vulnerabilities, strengthening the country’s technical test score. We also believe that Peru is likely to experience large foreign exchange inflows if there is another round of pension fund withdrawals, which bodes well for the currency (in addition to the sizable international reserves and limited external account pressures).

- Finally, we increased our hard currency quasi-sovereign exposure and local currency exposure in Indonesia. The main reason is that a temporary scare related to a potential policy rollback—which might have affected the central bank’s independence—seems to be over. Indonesia is slowly reverting to the fiscally orthodox path, while the recently ratified Job Creation Law (Omnibus Law) provides a firmer foundation for growth going forward. On the external side, the current account is expected to show further improvement in 2020, which should reduce pressure on the central bank to tighten. In terms of our investment process, this improved the country’s policy test score.

- We reduced our hard currency sovereign exposure in Costa Rica and hard currency corporate exposure in Mongolia. The Costa Rican government unexpectedly decided to pull and reassess its initial proposal to the IMF following large-scale demonstrations. The fact that the country’s congress was not on board was a major contributing factor. In terms of our investment process, this worsened the country’s policy test score. As regards Mongolia, the corporate bond that we held there experienced 20+ points price appreciation since May. We saw no discernible catalyst for further price upside and there was little support on the secondary market. In terms of our investment process, this worsened the technical test score for the company.

- We also continued to divest from hard currency corporate and quasi-sovereign exposure in Argentina and local currency exposure in Uruguay. In Argentina, we finalized the post-restructuring exit and took profits from the debt exchange in which we participated. Policy-wise, it is difficult to find any positive developments in Argentina. The government does not seem to be capable of handling the COVID pandemic, the international reserves continue to fall, the recovery stumbles, the gap between the official and market exchange rates is wide and there is no prospect of reforms. So, both economic and policy test scores for the country continue to worsen. The decision to exit Uruguay reflected more benign considerations—local valuations no longer look attractive and compelling after a big rally (in which we happily participated).

- Finally, we reduced our hard currency sovereign and corporate exposures in Israel. Our sovereign exposure was a low-spread off-index bond with a deteriorating technical test score. As regards the corporate exposure, this was also a technical downgrade—the company’s valuation went down by one “Bucket”, and, in addition, our holding was diluted by a parent company. So, we chose to take profit on our position and employ the money elsewhere.

Fund Performance

The VanEck Unconstrained Emerging Markets Bond UCITS Fund (USD I1 Inc) lost 0.01% in October compared to a gain of 0.20% for the 50/50 J.P. Morgan Government Bond Index-Emerging Markets Global Diversified (GBI-EM) local currency and the J.P. Morgan Emerging Markets Bond Index (EMBI) hard-currency index.

Turning to the market’s performance, GBI-EM’s biggest winners were Mexico, Indonesia, and South Africa. Its biggest losers were Turkey, Brazil and Poland. The EMBI’s biggest winners were South Africa, Egypt, and Ukraine. Its losers were Sri Lanka, Argentina and Costa Rica.

Average Annual Total Returns (%) as of 31 October 2020

| 1 Mo | 3 Mo | YTD | 1 Year | 5 Year | Life | |

| USD I1 Inc (Inception 20/08/13) | -0.01 | 0.64 | 1.04 | 7.39 | 4.48 | 2.33 |

| 50 GBI-EM GD / 50% EMBI GD | 0.20 | -1.63 | -3.21 | -1.38 | 4.82 | 2.56 |

Life performance for the indices is presented in USD as of Class I1 inception date of 20/8/13. The Fund's benchmark index (50% GBI-EM/50% EMBI) is a blended index consisting of 50% J.P. Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified (GD) and 50% J.P. Morgan Emerging Markets Bond Index (EMBI) GD. The J.P. Morgan GBI-EM GD tracks local currency bonds issued by Emerging Markets governments. The index spans over 15 countries. The J.P. Morgan EMBI GD tracks returns for actively traded external debt instruments in emerging markets, and is also J.P. Morgan’s most liquid U.S-dollar emerging markets debt benchmark. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used or distributed without J.P. Morgan’s written approval. Copyright 2014, J.P. Morgan Chase & Co. All rights reserved.

Source of all Data: VanEck, Bloomberg.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

16 April 2024

15 April 2024

04 March 2024

12 February 2024

01 February 2024