Die Beziehung zwischen dem NIW eines Bitcoin-ETPs und dem Bitcoin-Preis

18 Februar 2021

Mit einem Freund teilen

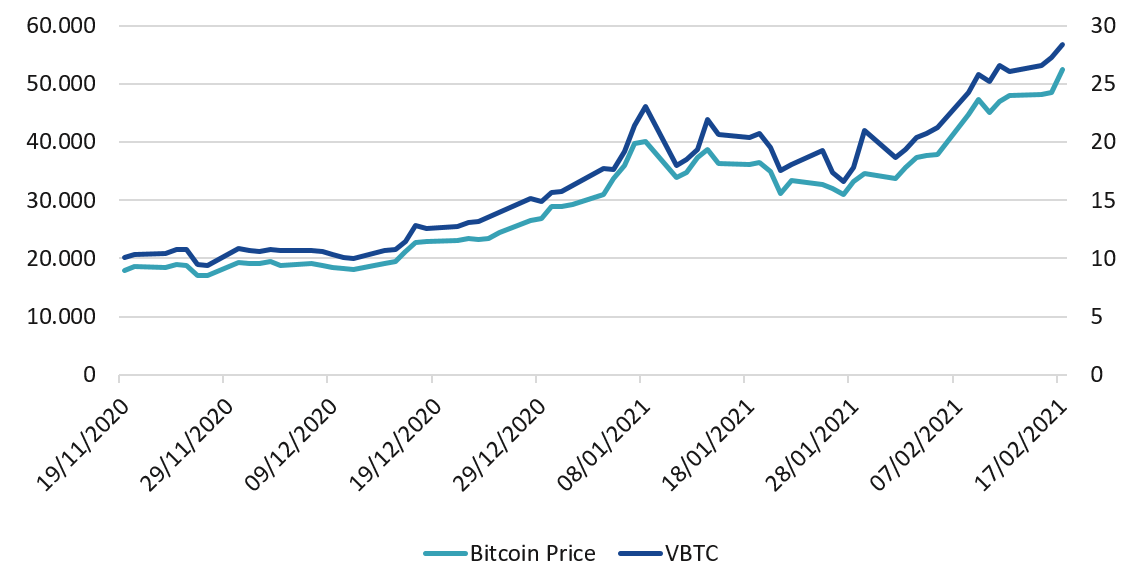

Alle Felder müssen ausgefüllt werden, wenn angegeben (*)Wir werden oft gefragt, wie sich der Kurs des VanEck Bitcoin ETN (Exchange Traded Note) zum Kurs von Bitcoin verhält. Denn während der Bitcoin ein Allzeithoch von rund 52.400 USD erreicht hat, ist der ETN – Stand 17. Februar 2021 – 28,3769 USD wert.

Bitcoin-Preis und NIW von VBTC

Quelle: VanEck.

Um diese Beziehung zu verstehen, ist es entscheidend zu wissen, was der Preis oder der Nettoinventarwert (NIW) eines ETNs darstellt:

„Der Nettoinventarwert (NIW) ist der Wert der Vermögenswerte eines Unternehmens abzüglich des Wertes seiner Verbindlichkeiten, oft in Bezug auf offene oder aktiv gemanagte Investmentfonds.”1

In unserem Fall ist der Nettoinventarwert pro ETN der Betrag an Bitcoin, den wir halten, bewertet auf täglicher Basis durch den Bitcoin-„Schlusskurs", abzüglich der Verbindlichkeiten (aufgelaufene Verwaltungsgebühr), geteilt durch die Anzahl der ausstehenden ETNs.

Jede Preisbewegung von Bitcoin (ob nach oben oder unten) spiegelt sich perfekt in der Preisbewegung des ETNs wider. Wenn der Kurs von Bitcoin um 10% steigt, steigt der Wert des ETNs um 10% (abzüglich der täglich anfallenden Verwaltungsgebühr). Wenn der Kurs von Bitcoin um 10% fällt, sinkt der Wert des ETNs ebenfalls um 10% (abzüglich der täglich anfallenden Verwaltungsgebühr).

Wie Sie in der Grafik sehen können, bewegt sich der NIW des Produkts im Gleichschritt mit dem Bitcoin-Preis, obwohl der Startwert niedriger ist. Wir haben uns dafür entschieden, den anfänglichen Wert des ETNs so niedrig wie möglich zu halten, damit sich der durchschnittliche Anleger ihn leisten kann – und gleichzeitig zu berücksichtigen, dass der Wert von Bitcoins erheblich sinken kann (Volatilität). Am 17. Februar 2021 entsprach ein ETN einer Sicherheit von 0,000556556 BTC. Anders ausgedrückt: Um einen Bitcoin zu halten, musste ein Anleger etwa 1.800 ETNs im Wert von 28,3769 USD kaufen.

Wichtige Hinweise

Ausschließlich zu Informations- und/oder Werbezwecken.

Dieser Artikel stammt von der VanEck (Europe) GmbH, Deutschland. Er ist nur dazu bestimmt, Anlegern allgemeine und vorläufige Informationen zu bieten, und sollte nicht als Anlage-, Rechts- oder Steuerberatung ausgelegt werden. Die VanEck (Europe) GmbH und ihre verbundenen und Tochterunternehmen (gemeinsam „VanEck“) übernehmen keine Haftung in Bezug auf Investitions-, Veräußerungs- oder Retentionsentscheidungen, die der Investor aufgrund dieses Artikels trifft. Dieser Artikel und die zum Ausdruck gebrachten Meinungen sind zum Veröffentlichungsdatum des Artikels aktuell und können sich mit den Marktbedingungen ändern. Bestimmte enthaltene Aussagen können Hochrechnungen, Prognosen und andere zukunftsorientierte Aussagen darstellen, die keine tatsächlichen Ergebnisse widerspiegeln. VanEck gibt keine ausdrücklichen oder stillschweigenden Zusicherungen oder Garantien hinsichtlich der Ratsamkeit von Investitionen in Wertpapiere oder digitale Vermögenswerte.

Anlagen sind mit Risiken verbunden, die auch einen möglichen Verlust des eingesetzten Kapitals bis hin zu einem Totalverlust einschließen können.

Ohne ausdrückliche schriftliche Genehmigung von VanEck ist es nicht gestattet, Inhalte dieser Publikation in jedweder Form zu vervielfältigen oder in einer anderen Publikation auf sie zu verweisen.

© VanEck (Europe) GmbH.

Wichtige Hinweise

Ausschließlich zu Informations- und/oder Werbezwecken.

Diese Informationen stammen von VanEck (Europe) GmbH, die von der nach niederländischem Recht gegründeten und bei der niederländischen Finanzmarktaufsicht (AFM) registrierten Verwaltungsgesellschaft VanEck Asset Management B.V. zum Vertrieb der VanEck-Produkte in Europa bestellt wurde. Die VanEck (Europe) GmbH mit eingetragenem Sitz unter der Anschrift Kreuznacher Str. 30, 60486 Frankfurt, Deutschland, ist ein von der Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) beaufsichtigter Finanzdienstleister. Die Angaben sind nur dazu bestimmt, Anlegern allgemeine und vorläufige Informationen zu bieten, und sollten nicht als Anlage-, Rechts- oder Steuerberatung ausgelegt werden. Die VanEck (Europe) GmbH und ihre verbundenen und Tochterunternehmen (gemeinsam „VanEck“) übernehmen keine Haftung in Bezug auf Investitions-, Veräußerungs- oder Retentionsentscheidungen, die der Investor aufgrund dieser Informationen trifft. Die zum Ausdruck gebrachten Ansichten und Meinungen sind die des Autors bzw. der Autoren, aber nicht notwendigerweise die von VanEck. Die Meinungen sind zum Zeitpunkt der Veröffentlichung aktuell und können sich mit den Marktbedingungen ändern. Bestimmte enthaltene Aussagen können Hochrechnungen, Prognosen und andere zukunftsorientierte Aussagen darstellen, die keine tatsächlichen Ergebnisse widerspiegeln. Es wird angenommen, dass die von Dritten bereitgestellten Informationen zuverlässig sind. Diese Informationen wurden weder von unabhängigen Stellen auf ihre Korrektheit oder Vollständigkeit hin geprüft noch können sie garantiert werden. Alle genannten Indizes sind Kennzahlen für übliche Marktsektoren und Wertentwicklungen. Es ist nicht möglich, direkt in einen Index zu investieren.

Alle Angaben zur Wertentwicklung beziehen sich auf die Vergangenheit und sind keine Garantie für zukünftige Ergebnisse. Anlagen sind mit Risiken verbunden, die auch einen möglichen Verlust des eingesetzten Kapitals einschließen können. Sie müssen den Verkaufsprospekt und die KID lesen, bevor Sie eine Anlage tätigen.

Ohne ausdrückliche schriftliche Genehmigung von VanEck ist es nicht gestattet, Inhalte dieser Publikation in jedweder Form zu vervielfältigen oder in einer anderen Publikation auf sie zu verweisen.

© VanEck (Europe) GmbH

Jetzt zum Newsletter anmelden

Verwandte Einblicke

Related Insights

20 April 2024

20 April 2024

26 Februar 2024

08 Februar 2024

07 Januar 2024