The Future of Streaming is… TV?

12 September 2022

Share with a Friend

All fields required where indicated (*)Entertainment is a well-established area of our smart homes, but as the number of streaming services increases, the offer has grown too big, too expensive and too complicated to navigate.

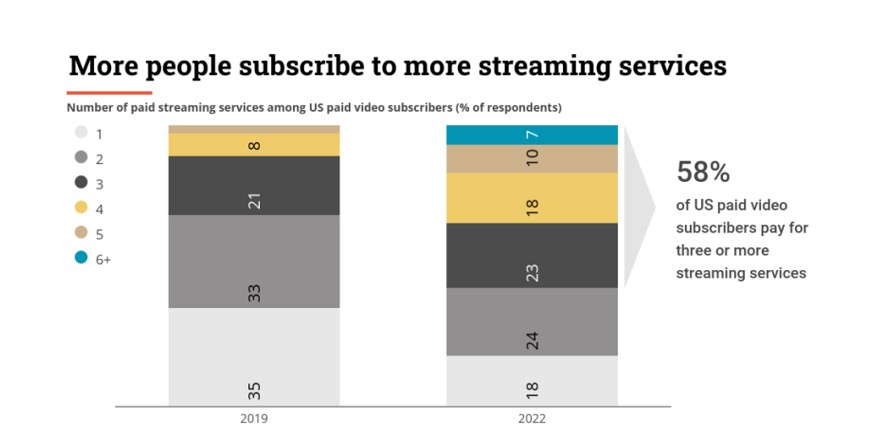

Consumers are already becoming overwhelmed with the growing number of streaming options. In 2019, only 32% of US paid video subscribers paid for three or more services, today it is 58%1. Recent streaming price hikes in combination with rising inflation, however, will have consumers look again at their subscriptions.

Source: Nielsen, April 2022 sourced from eMarketer.

To find a solution to this issue, streaming companies are seeking inspiration in the revenue-generating methods that served the traditional TV business well for decades, such as advertising and bundling. The secret ingredient, however, might be found in recommendation. Who will be able to surprise us with unexpected content that we otherwise might not have found?

Competing for subscribers and advertisers

The growing competition of both global and local streaming players is making it increasingly hard to grow. In response, companies are becoming more conscious of costs. Netflix2, for instance, is cutting costs through layoffs and downscaling in production. Warner Bros. Discovery is also taking a more sensible approach to budgets and has axed several big productions as a result.

In addition, streaming services are considering alternative models. Netflix and Disney+ are now adding advertising to their services, following the example of HBO Max, Peacock, and Hulu who already offered ad-based tiers.

Naturally, advertisers are pleased, since they will finally be able to reach those previously inaccessible viewers. Competition in the overall streaming market, however, will only increase. In addition to YouTube, subscription services will have to face free ad-supported streaming television (FAST) such as Paramount’s Pluto, Comcast’s Xumo, Fox’s Tubi, and Amazon’s Freevee.

Subscription services, however, will have to walk a fine line to ensure that their ad-based tiers will not cannibalize too many higher-tier customers, while still reaching enough people to attract quality advertisers. To keep the experience as entertaining as possible, subscription services might be able to push advertisers to invent new ad forms that are as entertaining as the content the streaming services already serve, instead of reusing the existing 30-second ad.

Distributing bundles with more than content

In addition to cheaper ad-based tiers, a streaming bundle with an aggregated discount might also be a reason to keep subscribing. Disney already offers such a bundle of streaming channels with Disney+, Hulu, and ESPN. Netflix, meanwhile, has expanded into games, although less than 1% of their subscribers are playing them3.

A bundle, however, doesn’t have to be limited to content. The traditional distributors – cable companies such as Liberty Global, Comcast or Charter – have always sold bundles of video content as part of a broader service that included internet and telephony. Their existing presence in people’s homes gives them a key advantage to regain their position.

Amazon, Apple and Google offer even broader bundles. Amazon Prime consists of fast shipping, exclusive access to sales, and entertainment services that include music, games, photos and books in addition to video. Apple One includes TV, games, music and cloud storage.

Recommending surprising content

With advertising and bundling, the industry might be able to give people more value for their money. Nevertheless, it doesn’t address the most challenging issue: how to navigate the ever-increasing amount of content.

Today, most streaming services use their own complicated algorithms to point us to content we might like based on what we watched before combined with the personal details they learned from us.

What would happen, however, if they could also take into account how we feel, what we’ve done during the day or plan to do the next day, or what happens in our social network. For instance, which movies a good friend of mine recently watched and recommended.

Some services already offer elements of such recommendations. Spotify, for instance, allows us to follow people we know or celebrities we admire, while Tiktok has created a lean-back experience. So far, however, the secret code has not been cracked.

Good recommendation should be able to point us to content that drives discussions at the watercooler, but also to content that we otherwise we never would have come across. Ideally, it combines the lean-forward experience of actively searching for specific content with the lean-back posture of the channel-surfing couch potato.

The service that cracks the recommendation code might surprise us. It could be a streaming service or a distributor, a retailer or a device manufacturer or perhaps it will be an integral part of another smart home service that we haven’t even imagined yet.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from Dasym Managed Accounts B.V. with registered address at Flevolaan 41 A, 1411 KC Naarden, the Netherlands (DMA), DMA is an investment company incorporated under Dutch law and regulated by the Dutch Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB). The information prepared by DMA is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. The views and opinions expressed in this presentation are those of the author(s) but not necessarily those of DMA. DMA and its associated and affiliated companies (together “Dasym”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Dasym makes no representation or warranty, express or implied, as to the accuracy or completeness of any of the information contained in this blog. Dasym undertakes no responsibility to update the information prepared by it and contained in this blog.

This information is published by VanEck (Europe) GmbH. VanEck (Europe) GmbH, with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin). The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Smart Home Active UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, engaged Dasym Managed Accounts B.V., an investment company regulated by the Dutch Financial Service Supervisory Authority (AFM), as the investment advisor for the Fund. The Fund is registered with the Central Bank of Ireland and actively managed. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

UK - Facilities Agent: Computershare Investor Services PLC

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Discrete performance shows 12-month performance to the most recent quarter-end for each of the last 10 years where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 months period and so on.

Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Dasym and VanEck.

© VanEck (Europe) GmbH / Dasym Managed Accounts B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

12 March 2024

09 February 2024

16 January 2024

08 December 2023