Why Economic Moats May Potentially Be Considered the Best Way to Buy US Stocks

15 February 2024

Share with a Friend

All fields required where indicated (*)To address the above-mentioned concerns, we partnered with the investment research firm Morningstar, which has developed a concept of Moat Investing. According to Morningstar, Moats are structural competitive advantages that allow a company to generate returns on invested capital (ROIC) in excess of its weighted average cost of capital (WACC) for extended periods. The wider the Moat is, the longer the company can sustain its competitive advantages.

Five Different Types of Moat

Morningstar identifies five different types of moats that companies possess. These are:

- Switching costs. The time or money that it takes a customer to switch from one producer/provider to another.

- Intangible assets. Things like such as brands, patents and regulatory licenses that block competition and/or allow companies to charge more.

- Network effect. Present when the value of a service grows as more people use a network.

- Cost advantage. This allows firms to sell at the same price as competition and gather excess profit and/or have the option to undercut competition.

- Efficient scale. When a company serves a market that’s limited in size, new competitors may not have an incentive to enter.

In order to build a basket of stocks that should outperform, Morningstar has built an index of stocks that not only have wide economic moats but are also attractively priced. It uses a discounted cashflow model to estimate fair value, adding stocks that appear cheap and removing those that look expensive.

Over the past 17 years, the Morningstar Wide Moat Focus Index has outperformed the S&P 500 index consistently as the charts below show.

History of Outperformance

Cumulative Return (%) / 28/02/2007 - 31/12/2023

Source: Morningstar.

Performance data quoted represents past performance. Past performance is not a guarantee of future results. Index performance is not illustrative of fund performance. For fund performance current to the most recent month-end, visit vaneck.com.

At VanEck, we have based ETFs on the Morningstar index for some time. For instance, we offer the VanEck Morningstar US Sustainable Wide Moat ETF. To complement this, we launched the VanEck Morningstar US Wide Moat ETF at the beginning of 2024. This ETF does not have a specific sustainability screen and tracks the Morningstar index This index is equally-weighted and therefore avoids the high levels of stock concentration in the S&P 500, while providing exposure to undervalued securities2. Please remember that the financial markets are constantly changing and investing in equities is risky.

Despite Recent Outperformance, the Index Continues to Offer an Attractive Discount to Fair Value

Time Period: 1/1/2014- 31/12/2023

Methodology: Weighted avg. P/FVE via security-level weightings in portfolio

Source: Morningstar Direct

Indexes are unmanaged and not available for direct investment

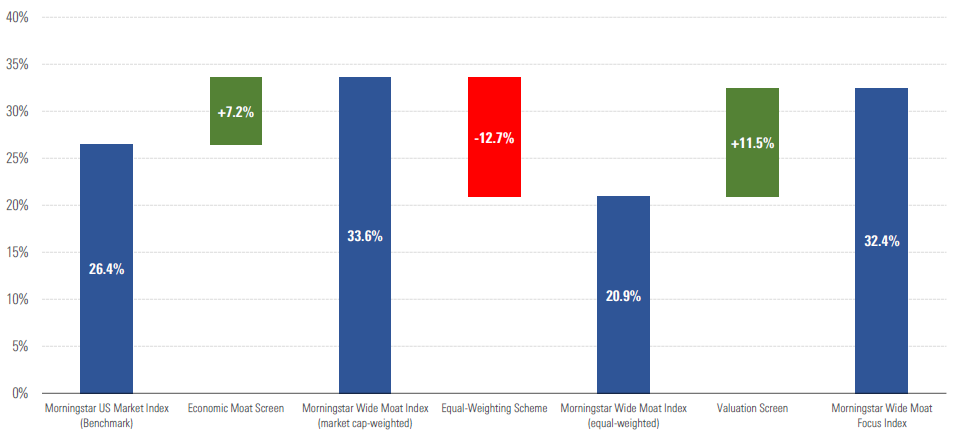

With the “Magnificent 7” stocks having driven over half of the broad market’s total returns in 2023, equal-weighted indices faced a performance headwind. Indeed, the Morningstar Wide Moat Index, a market cap-weighted index of all U.S. wide moat-rated stocks, outperformed its equal-weighted counterpart (as seen in the two middle blue bars below). However, the Morningstar Wide Moat Focus Index, which in addition to screening for wide-moat U.S. stocks also has a valuation screen, has historically outperformed its benchmark consistently. This historical performance is by no means a guarantee for future performance and investors in equity funds should consider the risk of (subastantial) capital loss.

The Index Overcame a Stiff Performance Headwind From Its Equal-Weighting Approach

Time Period: 1/1/2023 - 31/12/2023

Source: Morningstar Direct

Indexes are unmanaged and not available for direct investment

For those investors who prefer to buy US mid- and small-capitalization stocks, we have also launched the VanEck Morningstar US SMID Moat ETF. Over the long term — more than 20 years — US small and mid-sized (SMID) stocks have outperformed the large-cap market, but their valuations are now close to 20-year lows relative to large caps when valued on the well-known price/earnings ratio, according to Morningstar. Some investors might think it’s time that the discount was narrowed. Further, there is evidence that this area of the stock market is inefficient, leaving more scope for Morningstar analysts to find companies with wide moats that could potentially be trading at a discounted price.

SMID Cap Forward P/E Relative to Large Cap Forward P/E January 2004 - December 2023

Source: Bloomberg. SMID Cap Stocks represented by the Russell 2500 Index. Large Cap Stocks represented by the S&P 500 Index. See disclaimers and descriptions at the end of this presentation. Past performance is not indicative of future results.

The US economy hosts some of the world’s most dynamic businesses that are shaping the future of our economy. However, after last year’s exceptional investment gains, they are trading at high P/E multiples which may pose a threshold and defer investors from investing in them. Buying stocks with wide economic moats could be one way of countering that conundrum.

1 Past performance is not guarantee of future returns.

2 Based on Morningstar’s Equity Research. More than 100 analysts conduct company and industry research. Analyst rates the strength of competitive advantage, or moat: None, Narrow or Wide. Analyst uses discounted cash flow model to develop a Fair Value Estimate which represents the intrinsic value that company.

IMPORTANT INFORMATION

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: First Independent Fund Services Ltd, Feldeggstrasse 12, 8008 Zurich, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), who is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice.

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Morningstar US Wide Moat UCITS ETF, VanEck Morningstar US Sustainable Wide Moat UCITS ETF, VanEck Morningstar US SMID Moat UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company incorporated under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

UK - Facilities Agent: Computershare Investor Services PLC

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

The Morningstar® Wide Moat Focus IndexSM are service marks of Morningstar, Inc. and have been licensed for use for certain purposes by VanEck. VanEck Morningstar US Wide Moat UCITS ETF (the “ETF”) is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in the ETF.

Morningstar® US Small-Mid Cap Moat Focus IndexSM are service marks of Morningstar, Inc. and have been licensed for use for certain purposes by VanEck. VanEck Morningstar US SMID Moat UCITS ETF (the “ETF”) is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in the ETF.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

It is not possible to invest directly in an index.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2024

15 April 2024

15 March 2024

14 March 2024