Moat Stocks Stand Out in September

31 October 2019

Share with a Friend

All fields required where indicated (*)September was a strong month for the Morningstar® Wide Moat Focus IndexTM (“Moat Index”). It outperformed the S&P 500 Index by nearly two percent (3.79% vs. 1.87%, respectively), driven almost entirely by impressive stock selection.

Much of the positive return can be attributed to companies in the financial and information technology sectors. In particular, State Street Corp (STT) was the second best performing stock for the month and contributed to the strong performance of financials. Morningstar believes STT benefits from cost advantages in an industry where scale matters, as well as from high switching costs for clients that may wish to move custody to another bank. Information technology had several holdings with impressive returns, including Guidewire Software (GWRE) and Intel Corp. (INTC), which helped counterbalance Salesforce.com (CRM), September’s second worst performing stock. GWRE provides software to the property and casualty insurance industry and has been trading close to Morningstar’s fair value estimate in recent weeks, up markedly from its deep discount to fair value earlier this year.

Semiconductor companies such as INTC, Microchip Technology (MCHP), KLA-Tencor Corp. (KLAC) and Applied Materials (AMAT) have seen a large amount of price fluctuation over the past few months amidst the U.S.-China trade war, but they appear to be trending upward amid positive sentiment around the negotiations. Morningstar raised its fair value estimate for KLAC from $128 per share to $140 due to its leading position in the industry and high anticipated revenue.

The materials and energy sector exposure in the Moat Index posted notable performance, but did not contribute significantly to index return due to their low relative weightings. The sole materials company, Compass Minerals (CMP), and oil services company Core Laboratories (CLB) both posted double digit returns in September. CLB’s performance was particularly welcome in a month that saw its fair value downgraded from $67 per share to $59 by Morningstar.

Communication services was the only detracting sector, and its underperformance was modest. The sector’s performance was influenced most significantly by Facebook’s (FB) weak returns for the month.

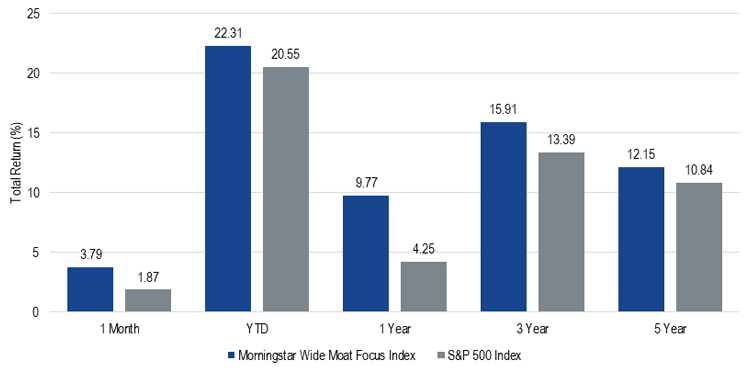

Moat Index Outperformance Across Multiple Periods

As of 30/9/2019

Source: Morningstar. Past performance is no guarantee of future results. Index performance is not illustrative of fund performance. For fund performance current to the most recent month-end, visit vaneck.com.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Morningstar US Sustainable Wide Moat UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets. Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

UK - Facilities Agent: Computershare Investor Services PLC

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

Morningstar® US Sustainability Moat Focus Index is a trade mark of Morningstar Inc. and has been licensed for use for certain purposes by VanEck. VanEck Morningstar US Sustainable Wide Moat UCITS ETF is not sponsored, endorsed, sold or promoted by Morningstar and Morningstar makes no representation regarding the advisability in VanEck Morningstar US Sustainable Wide Moat UCITS ETF.

Effective December 17, 2021 the Morningstar® Wide Moat Focus IndexTM has been replaced with the Morningstar® US Sustainability Moat Focus Index.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

It is not possible to invest directly in an index.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

11 March 2024

23 April 2024

15 March 2024

11 March 2024

20 February 2024

19 February 2024