Emerging Markets High Yield Bond ETF

VanEck Emerging Markets High Yield Bond UCITS ETF

Emerging Markets High Yield Bond ETF

VanEck Emerging Markets High Yield Bond UCITS ETF

Fund Description

The VanEck Emerging Markets High Yield Bond UCITS ETF offers the potential for higher returns than developed-market bonds, while also having the advantage of higher credit quality. The EM bond universe has grown substantially in the last years, and is now an attractive alternative to the developed world’s high yield markets.

-

NAV$114.76

as of 10 May 2024 -

YTD RETURNS4.36%

as of 10 May 2024 -

Total Net Assets$24.9 million

as of 10 May 2024 -

Total Expense Ratio0.40%

-

Inception Date20 Mar 2018

-

SFDR ClassificationArticle 6

Overview

Fund Description

The VanEck Emerging Markets High Yield Bond UCITS ETF offers the potential for higher returns than developed-market bonds, while also having the advantage of higher credit quality. The EM bond universe has grown substantially in the last years, and is now an attractive alternative to the developed world’s high yield markets.

- Potential for higher returns than developed market high-yield bonds

- Currently higher average credit rating than developed-market high yield

- Tracks a well-diversified index of corporate bonds

- Underlying bonds issued in USD

Risk factors:

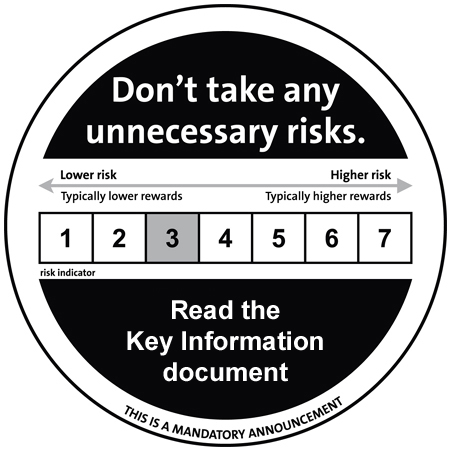

Emerging Markets Risk, High Yield Securities Risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index

Fund Highlights

- Potential for higher returns than developed market high-yield bonds

- Currently higher average credit rating than developed-market high yield

- Tracks a well-diversified index of corporate bonds

- Underlying bonds issued in USD

Risk factors: Foreign Currency Risk, Emerging Markets Risk, High Yield Securities Risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index

Performance

Holdings

Portfolio

Literature

Index

Index Description

The ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index is comprised of U.S. dollar-denominated bonds issued by non-sovereign emerging markets issuers that are rated below investment grade and that are issued in the major domestic and Eurobond markets.

Index Key Points

Underlying Index

ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index

Index Characteristics

In order to qualify for inclusion an issuer must have risk exposure to countries other than members of the FX G10, all Western European countries, and territories of the US and Western European countries. The FX-G10 includes all Euro members, the US, Japan, the UK, Canada, Australia, New Zealand, Switzerland, Norway and Sweden.

Individual securities of qualifying issuers must be denominated in US dollars, must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), must have at least one year remaining term to final maturity, at least 18 months to final maturity at point of issuance.

Liquidity

Bonds must have at least USD 300 million in outstanding face value and a fixed coupon.

Weighting Methodology

The Index constituents are capitalization-weighted based on their current amount outstanding times the market price plus accrued interest, subject to a 10% country of risk cap and a 3% issuer cap. Countries and issuers that exceed the caps are reduced to 10% and 3%, respectively, and the face value of each of their bonds is adjusted on a pro-rata basis.

Monthly Rebalance

Rebalance day occurs on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. Issues that no longer meet the criteria during the course of the month remain in the Index until the next month-end rebalancing at which point they are removed from the Index.

Index Provider

ICE Data Indices, LLC

For more information about the index please click here