US Fallen Angels ETF

VanEck US Fallen Angel High Yield Bond UCITS ETF

US Fallen Angels ETF

VanEck US Fallen Angel High Yield Bond UCITS ETF

Fund Description

VanEck currently manages the largest ETF fallen angels strategy in the world. VanEck US Fallen Angel High Yield Bond UCITS ETF offers access to corporate bonds initially issued with investment grade status and then downgraded to high yield. The bonds need to be US dollar denominated and issued in the US domestic market, by both US and non US issuers from developed countries. The strategy presents a strong track record and an interesting investment case, characterized by the following main points.

-

NAV$21,30

as of 26 apr 2024 -

YTD RETURNS-0,51%

as of 26 apr 2024 -

Total Net Assets$7,2 million

as of 26 apr 2024 -

Total Expense Ratio0,35%

-

Inception Date01 sep 2023

-

SFDR ClassificationArticle 6

Overview

Fund Description

VanEck currently manages the largest ETF fallen angels strategy in the world. VanEck US Fallen Angel High Yield Bond UCITS ETF offers access to corporate bonds initially issued with investment grade status and then downgraded to high yield. The bonds need to be US dollar denominated and issued in the US domestic market, by both US and non US issuers from developed countries. The strategy presents a strong track record and an interesting investment case, characterized by the following main points:

- Timing: corporate bonds are included when the downgrade to High Yield takes place, with historical evidence pointing to a subsequent price recovery.

- Contrarian Approach: by investing in downgraded bonds often an exposure to sectors undergoing turmoil is achieved. Examples include the financial sector in the aftermath of the GFC or the energy sector in 2016.

- Potentially oversold market dynamic: many institutional investors are forced by their mandates to own only investment grade securities, which could cause excessive selling pressure on the securities when the downgrade takes place.

- Rising stars: fallen angel bonds tend to display a higher tendency to regain investment grade status, when compared to the broad high yield spectrum.

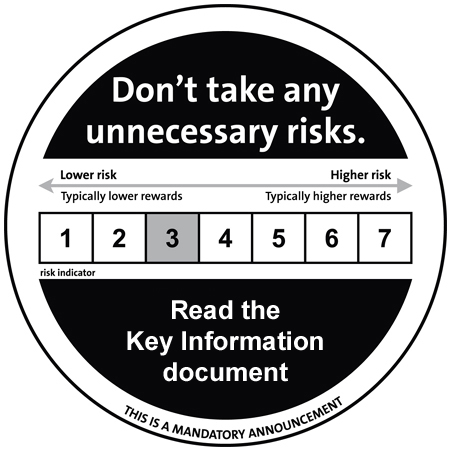

1Past performance is not a reliable indicator for future performance. Risk factors: You may lose money up to the total loss of your investment due to the Risk of Investing in high yield securities, Credit Risk and Interest Rate Risk as described in the Main Risk Factors,

and Prospectus.

Underlying Index

ICE US Fallen Angel High Yield 10% Constrained Index

Fund Highlights

- Timing: corporate bonds are included when the downgrade to High Yield takes place, with historical evidence pointing to a subsequent price recovery.

- Contrarian Approach: by investing in downgraded bonds often an exposure to sectors undergoing turmoil is achieved. Examples include the financial sector in the aftermath of the GFC or the energy sector in 2016.

- Potentially oversold market dynamic: many institutional investors are forced by their mandates to own only investment grade securities, which could cause excessive selling pressure on the securities when the downgrade takes place.

- Rising stars: fallen angel bonds tend to display a higher tendency to regain investment grade status, when compared to the broad high yield spectrum.

1Past performance is not a reliable indicator for future performance. Risk factors: You may lose money up to the total loss of your investment due to the Risk of Investing in high yield securities, Credit Risk and Interest Rate Risk as described in the Main Risk Factors,

and Prospectus.

Underlying Index

ICE US Fallen Angel High Yield 10% Constrained Index