ChatGPT Guide for Financial Advisors

Share with a Friend

All fields required where indicated (*)ChatGPT is probably the most widely known AI-powered tool out there. So how can advisors use it?

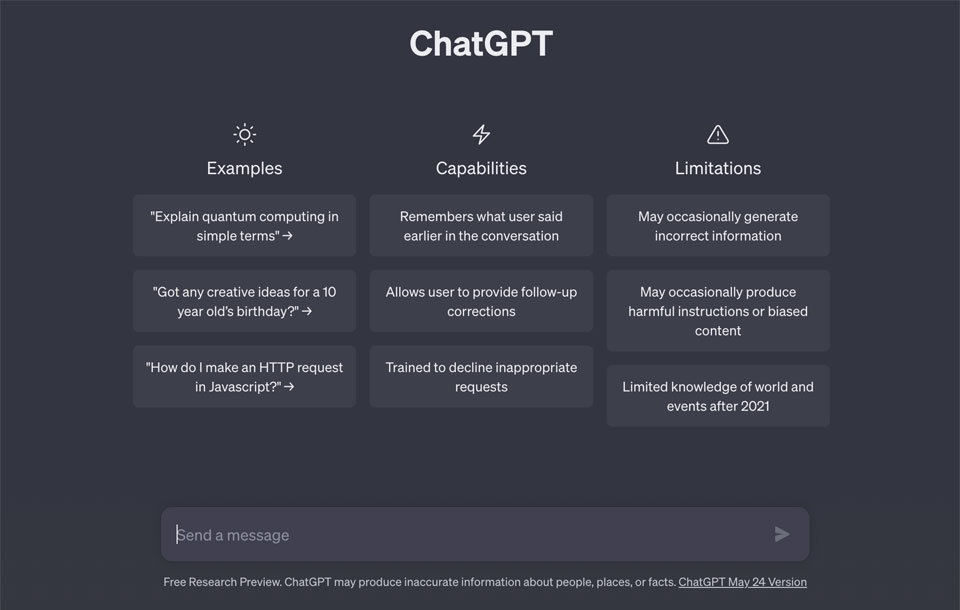

Artificial Intelligence (AI) will forever change the way we work. If you’re not at least researching different tools or ways to use it in the future, you’re already behind. ChatGPT is probably the most widely known AI-powered language model tool out there. So, let’s take a look at how financial advisors can use it.

Learning to navigate ChatGPT is relatively easy and, if used in the right ways, can help your practice save time and enhance your client outreach. Some of the key functions of ChatGPT include being able to answer client inquiries, create personalized emails, produce custom worksheets, and create intake forms. This step-by-step guide will help financial advisors get started and effectively utilize ChatGPT in their practice.

A word of caution before we jump in. The AI application is simple to use but there are helpful “do’s” and “don’ts” to remember while using ChatGPT to understand the limitations and advantages. Every system has its limitations, the language model should not be used for market predictions or decisions since it is not error-proof. Another important “don’t” is that ChatGPT should not be a single source of research because the tool often makes things up, so users must verify all information. Never enter any proprietary data or information into ChatGPT; it will be permanently entered into the learning model. To learn more about how advisors should and should not use AI right now, be sure to read our recent blog on how advisors can use AI for their practice.

ChatGPT Three Step Guide

Step 1. “Access and create an account for ChatGPT

- Access ChatGPT by clicking here: https://chat.openai.com/

Step 2. “Engage with ChatGPT by asking questions.”

- Start typing your request or ask a question in the “Send a message box”

- Formulate questions and requests in clear and concise language.

- Structure your queries effectively to ensure accurate responses.

- Provide necessary context and information to help ChatGPT understand the specific requirements.

Reminders

- Advisors should note, however, that the data and knowledge of this AI tool cuts off at September 2021. Any timely market insights or updates cannot be directly produced by using ChatGPT.

- Remember that information pulled from ChatGPT may not be accurate, so it is important that advisors do their own research and fact-checking.

- ChatGPT should not be used to generate website content – Google and Bing will know.

Step 3. “Try additional prompts or add to original prompt.”

- To learn more information about a subject, a ChatGPT user may add additional details and refine questions to receive different results. Type the new question into “send a message” and ChatGPT will write an updated response. Continue this process until satisfied with the explanation.

Tone Matters – ChatGPT Can Help With That.

Worried about your voice not translating? ChatGPT will write in a tone that most suites your practice and client base. Try including these at the end of your prompts:

“Write using a formal business appropriate tone.”

“Write in a conversational tone.”

“Write in a persuasive tone."

Here’s How You Can Start Using ChatGPT Right Away

Quickly address common client inquiries by utilizing ChatGPT's ability to provide immediate answers. After financial advisors are comfortable with the tool, it can be used for compelling subject lines for emails, blog titles and outlines, social post ideas, and agendas. Below are two samples, an introduction letter and a client intake form, on how advisors can use ChatGPT for simple tasks.

Sample 1. Introduction Letter

Advisor PROMPT: Write a letter introducing myself to a prospective client. My name is John Smith. I have worked at XYZ Advisory Services for 30 years and my team manages $1 Billion in assets.

ChatGPT Response:

Dear [Prospective Client's Name],

I hope this letter finds you well. My name is John Smith, and I am writing to introduce myself and XYZ Advisory Services, a firm that I have proudly been a part of for the past 30 years. With a strong track record of success, our team has been entrusted to manage a substantial portfolio of $1 billion in assets.

I am delighted to have the opportunity to reach out to you and explore how our services can benefit you and your financial objectives. Over my extensive career, I have had the privilege of working with a diverse range of clients, helping them navigate the complexities of the financial landscape and achieve their goals.

At XYZ Advisory Services, we understand that every client is unique, and we take a tailored approach to address your specific needs. Our team of seasoned professionals combines deep expertise with a commitment to providing personalized guidance and support. We are dedicated to delivering comprehensive wealth management solutions that align with your long-term aspirations.

With our extensive experience and access to a wide range of investment opportunities, we strive to build enduring relationships with our clients based on trust, transparency, and results. Our focus is on delivering consistent and reliable performance while proactively adapting to changing market dynamics.

I would be delighted to arrange a meeting at your convenience to discuss your financial goals and explore how our services can assist you in reaching them. I am confident that our expertise and dedication can make a positive impact on your financial well-being.

Please feel free to contact me at [Your Phone Number] or [Your Email Address] to schedule a meeting or if you have any questions. I look forward to the opportunity to work with you and develop a successful partnership.

Thank you for considering XYZ Advisory Services

Sample 2. Client Intake Form

Advisor Prompt: Build an intake form for new clients with 10 simple questions that I would need to know about them. I am a financial advisor, that needs to understand my clients' goals, current income, spending habits, and risk tolerance.

ChatGPT Response:

Certainly! Here's a sample intake form for new clients with 10 simple questions that can help you understand their financial situation and goals:

Full Name:

Contact Information (Email, Phone):

Age:

Current Employment Status:

Monthly Income (after taxes):

Monthly Expenses (including rent/mortgage, bills, loans, etc.):

Do you have any existing savings or investment accounts? If yes, please provide details:

What are your financial goals in the short term (next 1-3 years)?

What are your financial goals in the long term (next 5 years or more)?

On a scale of 1 to 10, with 1 being very conservative and 10 being very aggressive, what is your risk tolerance when it comes to investing?

*Feel free to customize the questions according to your specific requirements and preferences. This form will provide you with a good starting point to gather essential information about your clients and better understand their financial needs.

Try it out!

By leveraging ChatGPT, financial advisors can enhance their client interactions, improve research efficiency, and stay at the forefront of their field. Following this three step guide will help financial advisors effectively utilize ChatGPT in their professional practice.

IMPORTANT DISCLOSURES

Prior to using any AI tools, please consult your compliance and legal departments to assess and mitigate potential risks associated with its application in your specific regulatory environment.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries mentioned in this blog.

This is not an offer to buy or sell or a recommendation to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.