GEODNET: Why We're Bullish

April 19, 2024

Read Time 10+ MIN

Please note that VanEck may have a position(s) in the digital asset(s) described below.

We are excited to announce that VanEck has made an investment in GEODNET’s GEOD token. This investment was made directly with the GEODNET Foundation. Post purchase, VanEck owns less than 50bps of a fully diluted supply of GEOD tokens. We have chosen to allocate to GEOD tokens because GEODNET is a unique, revenue-generating business that sagely employs crypto-economics to provide a cheaper, superior service compared to incumbent businesses. Furthermore, GEODNET occupies a niche in a briskly growing market, with a 10.5% compound annual growth rate (CAGR) and substantial upside potential from autonomous vehicle technologies.

- What is GEODNET?

- GEODNET: Precise in Location Data

- GEODNET: How the Network Functions

- GEODNET: How the Economics Work

- GEODNET: Key Performance Indicators

- GEODNET: Current and Potential Use Cases

- GEODNET: Comparison to Non-Crypto Businesses

- GEODNET: Valuation Framework

- GEODNET: Key Risks

What is GEODNET?

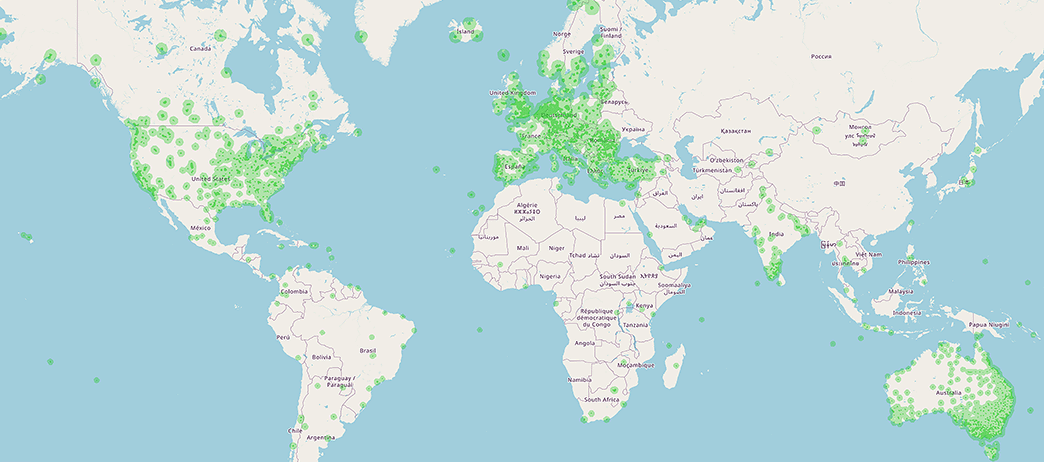

GEODNET is a project that utilizes cryptocurrency to bootstrap a network of GNSS, Global Navigation Satellite Systems like GPS, and correction services that substantially improve the accuracy of location data. Using token incentives, we believe GEODNET has done an exceptional job bootstrapping a network of 5,061 nodes to provide real value to end users. Already, GEODNET is generating meaningful revenue from customers who are substituting GEODNET’s data over more expensive alternatives. GEODNET has created products for users in agriculture, drones, construction, and IoT. As of March 2024, GEODNET boasts an annualized recurring revenue (ARR) of $630k. We forecast that GEODNET will increase its market share of the $3.4B GNSS correction market because GEODNET’s service is substantially cheaper while offering higher location fidelity than many incumbents.

Source: GEODNET as of 4/4/2024.

GEODNET: Precise in Location Data

Satellite-based location systems, such as GPS (USA), GLONASS (Russia), Galileo (Europe), and BeiDou (China), are premised on a constellation of satellites that transmit signals to allow people on the ground to infer location data. Due to atmospheric interference, space weather, and satellite time synchronization errors, those signals are degraded to only be accurate within 10-20 feet. While this is adequate for many applications, more is needed for many advanced use cases of location data. GEODNET provides location accuracy of around ½ inch with re-positioning updates every second. GEODNET matches or exceeds the capabilities of competitors and is done so at a fraction of competitor price points.

Some of these include precision farming, building advanced surveying and building construction, urban planning, mapping, and navigation. For example, John Deere’s AutoTrac is an upgrade for existing tractors to allow the trackers to self-drive to reduce waste, improve yields, and increase energy efficiency. Products such as AutoTrac and other similar auto-steering and guidance kits can directly use real-time kinematics (RTK) data from networks like GEODNET to operate at high precision.

Source: John Deere as of 4/4/2024.

GEODNET: How the Network Functions

GEODNET is in the decentralized physical infrastructure networks, or DePIN, class of crypto projects that employs token incentives to create a network of physical infrastructure. Similar to DIMO, Hivemapper, and Helium, GEODNET distributes tokens to people who run hardware to create a network of “miners” that supplies useful services. In the case of GEODNET, the miners operate internet-connected devices that collect satellite positioning signals and make them more accurate. Users buy these devices using their own money, which is available from online retailers and install them according to instructions online. While users can purchase devices through GEODNET partners, GEODNET supports a variety of devices built by dozens of different manufacturers. As such, its network is not reliant upon one or even several suppliers.

Users must install devices with a clear view of the night sky to track incoming satellite signals. After a user installs the device, he must set up a wallet, and the user’s location is auto affirmed with the GNSS receiver with a crypto chip built into it. The user maintains the device, which interprets incoming GNSS satellite signals and transmits the correction data to a centralized, off-chain repository. GEODNET miners each exist within a subdivision called a Hex. A Hex is a hexagonal area around the miner that is 20km from side to side. While many miners can exist within the same Hex, additional miners, after the first reliable miner, receive decreased rewards. Within each Hex, the miner can provide GPS correction data that provides ½ inch accuracy to any end users operating within that Hex.

GEODNET: How the Economics Work

In exchange for remitting consistent correction data, miners receive GEOD tokens. Currently, miners receive, on average, 48 GEOD tokens per day in exchange for a triple-band (high fidelity) miner and 24 for a dual-band (lower quality). At present, this translates into $4,029.60 worth of tokens per year, meaning that a user’s device costs ($700 to buy a device) are paid back in around two months. As such, GEODNET does not itself pay for its network’s miners, and thus, it does not have to outlay tens of millions of dollars for devices, real estate, permits, and internet connectivity. Founder Mike Horton tried to bootstrap a network similar to GEODNET but ran into high capital costs, complex site acquisition and permitting processes, and other expensive obstacles. In essence, miners outlay capital to create a network and are rewarded directly in an incentive, the token, that rises in value as the network becomes more valuable.

Current System - CORS (Base Stations)

Source: GEODNET as of 4/4/2024.

End-users who want to receive correction data can either purchase the wholesale data directly from the GEODNET Foundation or they can purchase products and services that rely upon GEODNET data from 3rd parties. While some competitors price differentiate their offerings based upon latency and accuracy of the signal, GEODNET provides its highly accurate data of the same quality to all. Customers can buy GEODNET data directly from GEODNET or its partners and pay using traditional payment methods. They can also buy devices that utilize precise location data, like construction surveying equipment, from a third-party reseller who utilizes GEODNET data on the back end. One of the benefits of GEODNET’s partnership model is that it allows different use cases to command different prices. This is possible because GEODNET has a 50/50 revenue share with third-party re-sellers.

Because GEODNET has removed many of the costs of running its GNSS enhancement network, it has a substantial pricing advantage over its competitors. For example:

| Service | Annual Price | Accuracy | Latency |

| Terrastar L | $400 | 15-20cm | 5 min |

| ublox | $660 | 3-6cm | 30s |

| Point One | $600 | 10cm | 5s |

| Omnistar | $1,100 | 10cm | n/a |

| VRS Now | $1,850 | 2cm | 8s |

| Terrastar C | $1,050 | 2.5cm | 3 min |

| GEODNET | $400 | 1cm | 1s |

Source: VanEck Research as of 4/4/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

Since GEODNET is a non-profit organization chartered in Singapore, there is no equity component. The result is that GEODNET currently utilizes 80% of its revenues to buy GEOD tokens in the open market and GEODNET then burns those tokens. This is vastly superior to the share buyback model, as burned tokens can never again be re-issued. The buy/burns are done transparently and this is the mechanism by which GEODNET translates its network’s revenues into value for the token.

Source: HYFIX.AI as of 4/4/2024.

GEODNET: Key Performance Indicators

GEODNET is a highly scalable two-sided network. The foundation of the network is the nodes that transmit the location data, the supply side, and the corresponding coverage area. At the time of writing, there were 5,061 nodes that provided significant coverage across 60 countries on all seven continents. On the flip side is the demand for the services. This is how much money customers are paying to utilize GEODNET’s network. In March 2024, GEODNET earned $52K in revenue, which corresponds to an annual revenue rate of ~$630K. Because of the nature of GEODNET’s business, this is recurring revenue.

GEODNET Network Size and Annual Recurring Revenue (ARR) Growth >2x in 1 Year

Source: GEODNET as of 4/4/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

GEODNET: Current and Potential Use Cases

The real-time kinematics (RTK) market is estimated to be a $3.4B market with diverse applications that range from construction to agriculture to automated driving. Adding more precise location data to many different businesses and services brings substantial value to end users through cost-savings and new product capabilities. One interesting product that has been greatly improved directly from GEODNET’s services is robotic lawnmowers. Using high fidelity enables these devices to perform their functions faster and with less wasted energy.

Already, farmers can employ RTK technology to improve agronomy to enable smarter, more efficient application of pesticides, fertilizers and seeding due to improved mapping of soil sampling. RTK technology and the suite of opportunities it enables will help farmers save money while reducing the amount of pollution they emit. For construction businesses, GEODNET not only allows builders to understand precise map location, but also near-exact vertical location as well.

In the future, technologies such as Advanced Driver Assistance Systems and Lane-Level navigation will depend on hyper-precise positioning. Additionally, there is a long tail of AR/VR applications who can massively benefit from GEODNET’s position accuracy.

GEODNET: Comparison to Non-Crypto Businesses

While small, private businesses operate regional networks to sell precision location data, the most reasonable publicly traded comparison to GEODNET is Trimble (TRMB). Though Trimble is a different enterprise than GEODNET in many respects, its principal component is the monetization of geospatial data. Additionally, both GEODNET and Trimble have similar-sized networks at ~5k nodes.

Trimble is a business that offers software, hardware, and services that rely upon or create geospatial data for a diverse array of end markets. Its customers include agriculture, construction, engineering, surveying, maritime industries, and more. Basically, Trimble touches any sector that must incorporate or produce geospatial information as a core part of its business. To bring value to its customers, Trimble offers a diverse suite of hardware products that also include software and services.

Trimble operates as a "solutions” enterprise that begins with low-margin hardware but ultimately drives customers to high-margin ARR businesses like software and services. Trimble makes money not only by “selling” geospatial data but also by allowing its customers to generate that data, analyze it, and use that data to power Trimble-manufactured products/software. This business approach necessitates substantial investments in manufacturing, inventory, and a robust sales force.

As such, Trimble’s GNSS correction services segment is embedded as a component of its broader approach. The consequence of Trimble’s multifaceted arrangement is arguably a lower-margin business that compensates for reduced margins by focusing on customer lock-in. To wit, 53% of Trimble’s revenue in 4Q2023 was recurring, while its free cash flow (FCF) margin was 14.6%. Because of these dynamics and due to Trimble’s slow but steady growth, TRMB’s equity has traded at an average of 28.75x its FCF since the beginning of 2022.

By contrast, GEODNET operates as a pure information business that provides useful data that is sold wholesale or re-marketed by other businesses as part of those businesses’ integrated product or service offerings. GEODNET’s approach is special because it outsources data collection to service providers who are paid using GEOD tokens. At the same time, GEODNET uses partnerships to outsource sales of its data to service businesses and OEMs who incorporate GEODNET’s precision data as part of their product or services.

As such, GEODNET is a business that does not own its network, manufacture products, or even maintain sales channels for products that utilize its data. GEODNET is a network whose value is the information it provides rather than the bevy of services stapled on top of it.

GEODNET is a pure network value.

We foresee a future where many companies like Trimble deprecate their existing corrections network in order to use GEODNET. Realistically, Trimble’s existing GNSS correction network is a cost center that facilitates its core business services. We project that by replacing its network with GEODNET, Trimble can save $50M in annual personal protective equipment (PPE) expenses.

GEODNET: Valuation Framework

We arrive at the 2030 valuation of GEODNET based upon a 30x cash flow multiple. We select this conservative multiple as it corresponds to comparable companies like TRMB. The cashflows are then used to buy back tokens. We estimate the cashflows by projecting the market size for the GNSS correction market and then assume GEODNET is able to achieve a 5% market share. We believe that this is feasible and may even underestimate GEODNET’s potential due to:

- High network replication costs

- Niche industry based upon relationships and asymmetric knowledge

- Strong pipeline of customers and high leadership reputation in the industry

- Long-term cost advantage

- Well-seasoned team with past success building businesses

The result is that we project a 2030 token price of $9.58 based upon an 80% net margin that is applied to the buyback and burn of the token and a token supply of 640M.

Past performance is no guarantee of future results. The information, valuation scenarios, and price targets in this blog are not intended as financial advice or any call to action, a recommendation to buy or sell, or as a projection of how GEODNET’s GEOD token will perform in the future. Actual future performance of GEODNET’s GEOD token is unknown and may differ significantly from the hypothetical results depicted here. There may be risks or other factors not accounted for in the scenarios presented that may impede the performance. These are solely the results of a simulation based on our research and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

GEODNET: Key Risks

The key risks of GEODNET stem from incumbents replicating its service or using existing competitive advantages to box out GEODNET. Similarly, there are risks to its crypto reward structure that is premised on its token continuing to have value. There are also technological threats posed by 6G cellular networks, WiFi location triangulation, and similar technologies to provide very inexpensive or free high-precision location data. See below for more color on the key risks to GEODNET.

- Legal structure

- The legal structure of the buyback and burn model may not have a solid legal foundation

- Change in buyback structure to be below 80%

- Metastable System

- Token incentives drop too rapidly due to yearly halvening to drive network growth

- Drops to 0.56 per base station, per day, by 2030

- Price catalyzes a death spiral as the network declines due to the collapse of incentives

- Token incentives drop too rapidly due to yearly halvening to drive network growth

- Competitive response

- Someone akin to American Tower sees value in this business and decides to replicate it using its network

- Competing technologies

- For example, novel approaches like utilizing future Wi-Fi or 6thGeneral Cellular signals might be enhanced to allow precise location data to be obtained cheaper or even for free

- Sales channels cannot interdict incumbents

- Existing incumbents have location correction services integrated at the point of manufacture of devices and the creation of software

- Resale of data without a license

- Hacking and remitting the data without a license may cannibalize revenues

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

To receive more Digital Assets insights, sign up in our subscription center.

Related Topics

DISCLOSURES

Coin Definitions

- GEODNET is a project that utilizes cryptocurrency to bootstrap a network of GNSS, Global Navigation Satellite Systems like GPS, and correction services that substantially improve the accuracy of location data.

- DIMO (DIMO), short for Digital Infrastructure for Moving Objects, is a cryptocurrency that aims to enhance the way vehicle owners interact with their cars.

- Hivemapper is a decentralized mapping network that aggregates road-level imagery and data.

- Helium (HNT) is a decentralized blockchain-powered network for Internet of Things (IoT) devices.

Risk Considerations

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

The information, valuation scenarios and price targets presented on any digital assets in this blog are not intended as financial advice, a recommendation to buy or sell these digital assets, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance these digital assets; their actual future performance is unknown, and may differ significantly from any valuation scenarios or projections/forecasts herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

Past performance is not an indication, or guarantee, of future results. Hypothetical or model performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading, and accordingly, may have undercompensated or overcompensated for the impact, if any, of certain market factors such as market disruptions and lack of liquidity. In addition, hypothetical trading does not involve financial risk and no hypothetical trading record can completely account for the impact of financial risk in actual trading (for example, the ability to adhere to a particular trading program in spite of trading losses). Hypothetical or model performance is designed with benefit of hindsight.

Index performance is not representative of fund performance. It is not possible to invest directly in an index.

Investments in digital assets and Web3 companies are highly speculative and involve a high degree of risk. These risks include, but are not limited to: the technology is new and many of its uses may be untested; intense competition; slow adoption rates and the potential for product obsolescence; volatility and limited liquidity, including but not limited to, inability to liquidate a position; loss or destruction of key(s) to access accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the internet; cybersecurity risks; and the lack of regulation and the potential for new laws and regulation that may be difficult to predict. Moreover, the extent to which Web3 companies or digital assets utilize blockchain technology may vary, and it is possible that even widespread adoption of blockchain technology may not result in a material increase in the value of such companies or digital assets.

Digital asset prices are highly volatile, and the value of digital assets, and Web3 companies, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

Digital assets are not generally backed or supported by any government or central bank and are not covered by FDIC or SIPC insurance. Accounts at digital asset custodians and exchanges are not protected by SPIC and are not FDIC insured. Furthermore, markets and exchanges for digital assets are not regulated with the same controls or customer protections available in traditional equity, option, futures, or foreign exchange investing.

Digital assets include, but are not limited to, cryptocurrencies, tokens, NFTs, assets stored or created using blockchain technology, and other Web3 products.

Web3 companies include but are not limited to, companies that involve the development, innovation, and/or utilization of blockchain, digital assets, or crypto technologies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© Van Eck Associates Corporation.

DISCLOSURES

Coin Definitions

- GEODNET is a project that utilizes cryptocurrency to bootstrap a network of GNSS, Global Navigation Satellite Systems like GPS, and correction services that substantially improve the accuracy of location data.

- DIMO (DIMO), short for Digital Infrastructure for Moving Objects, is a cryptocurrency that aims to enhance the way vehicle owners interact with their cars.

- Hivemapper is a decentralized mapping network that aggregates road-level imagery and data.

- Helium (HNT) is a decentralized blockchain-powered network for Internet of Things (IoT) devices.

Risk Considerations

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

The information, valuation scenarios and price targets presented on any digital assets in this blog are not intended as financial advice, a recommendation to buy or sell these digital assets, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance these digital assets; their actual future performance is unknown, and may differ significantly from any valuation scenarios or projections/forecasts herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

Past performance is not an indication, or guarantee, of future results. Hypothetical or model performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading, and accordingly, may have undercompensated or overcompensated for the impact, if any, of certain market factors such as market disruptions and lack of liquidity. In addition, hypothetical trading does not involve financial risk and no hypothetical trading record can completely account for the impact of financial risk in actual trading (for example, the ability to adhere to a particular trading program in spite of trading losses). Hypothetical or model performance is designed with benefit of hindsight.

Index performance is not representative of fund performance. It is not possible to invest directly in an index.

Investments in digital assets and Web3 companies are highly speculative and involve a high degree of risk. These risks include, but are not limited to: the technology is new and many of its uses may be untested; intense competition; slow adoption rates and the potential for product obsolescence; volatility and limited liquidity, including but not limited to, inability to liquidate a position; loss or destruction of key(s) to access accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the internet; cybersecurity risks; and the lack of regulation and the potential for new laws and regulation that may be difficult to predict. Moreover, the extent to which Web3 companies or digital assets utilize blockchain technology may vary, and it is possible that even widespread adoption of blockchain technology may not result in a material increase in the value of such companies or digital assets.

Digital asset prices are highly volatile, and the value of digital assets, and Web3 companies, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

Digital assets are not generally backed or supported by any government or central bank and are not covered by FDIC or SIPC insurance. Accounts at digital asset custodians and exchanges are not protected by SPIC and are not FDIC insured. Furthermore, markets and exchanges for digital assets are not regulated with the same controls or customer protections available in traditional equity, option, futures, or foreign exchange investing.

Digital assets include, but are not limited to, cryptocurrencies, tokens, NFTs, assets stored or created using blockchain technology, and other Web3 products.

Web3 companies include but are not limited to, companies that involve the development, innovation, and/or utilization of blockchain, digital assets, or crypto technologies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© Van Eck Associates Corporation.