Europe ETF

VanEck Sustainable European Equal Weight UCITS ETF

Europe ETF

VanEck Sustainable European Equal Weight UCITS ETF

Fund Description

The VanEck Sustainable European Equal Weight UCITS ETF invests in 100 of the most liquid, highly capitalised (free float) companies from European industrialised nations that comply with the UN Global Compact Principles for responsible corporate behavior. Additionally, it excludes sectors that do not follow responsible business practices, including: alcohol, animal testing, military, weapons, gambling, pornography, tobacco, nuclear power.

-

NAV€75.41

as of 10 May 2024 -

YTD RETURNS9.24%

as of 10 May 2024 -

Total Net Assets€49.6 million

as of 10 May 2024 -

Total Expense Ratio0.40%

-

Inception Date01 Oct 2014

-

SFDR ClassificationArticle 8

Overview

Fund Description

The VanEck Sustainable European Equal Weight UCITS ETF invests in 100 of the most liquid, highly capitalised (free float) companies from European industrialised nations that comply with the UN Global Compact Principles for responsible corporate behavior. Additionally, it excludes sectors that do not follow responsible business practices, including: alcohol, animal testing, military, weapons, gambling, pornography, tobacco, nuclear power.

- Sustainable, exclusion-based investing in line with the UN Global Compact Principles

- Equally weighted, diversified exposure to European companies with a maximum weighting of 20% per country

- Backed by sustainability intelligence from VE, part of Moody’s ESG solutions

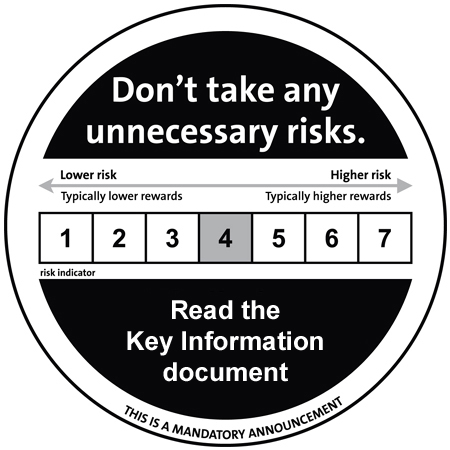

Risk Factors: Foreign currency risk, equity market risk, industry or sector concentration risk, risk of investing in smaller companies. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

Solactive European Equity Index GTR (TGLOTETR)

Fund Highlights

- Sustainable, exclusion-based investing in line with the UN Global Compact Principles

- Equally weighted, diversified exposure to European companies with a maximum weighting of 20% per country

- Backed by sustainability intelligence from VE, part of Moody’s ESG solutions

Risk Factors: Foreign currency risk, equity market risk, industry or sector concentration risk, risk of investing in smaller companies. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

Solactive European Equity Index GTR (TGLOTETR)

Performance

Holdings

Portfolio

Distributions

Literature

Index

Index Description

The Solactive European Equity Index tracks the performance of a selection of the top 100 shares from European developed markets. It is an equally weighted index with a 20% country cap.

Index Key Points

Underlying Index

Solactive European Equity Index GTR (TGLOTETR)

Index composition

The (general) criteria below apply to the (composition of the) Solactive European Equity Index:

- First shares are selected with a primary stock-market listing in developed European countries, as described in the ‘Solactive European Equity Index Guideline’;

- Exclusively ordinary and preferred shares and Depositary Receipts are eligible;

- Limited Partnerships are excluded;

- Exclusively shares with semi-annual average trading volume of EUR 10 million per day are eligible;

- Only the most liquid listing for each company is eligible;

- The 100 largest shares are then selected based on free float market capitalisation;

- On the Pool of Stocks resulting from above an ESG sustainability screening is applied based on indications from Vigeo EIRIS. This screening is based on the ten principles of the UN Global Compact as well as specific exclusions related to controversial sectors

- The Index is equally weighted on the reweighting date, after that the weighting can vary due to price fluctuations;

- The Index has an annual reconstitution and is rebalanced at the same time on the fourth Tuesday of March so that the 100 shares are again equally weighted. Shares can also be added or removed. If this is not a Trading Day, the reweighting takes place on the next Trading Day;

- In addition to the annual Index reweighting and reconstitutiton, there is a quarterly index review, where the composition of the Index is screened for any ESG sustainability breaches. The review date is the last Trading Day of May, August and November. The effective date is the third Tuesday of June, September and December; and

- For each country, the weighting in the Index is capped at 20% at the moment of reweighting.

Index Provider

Solactive